Credit underwriting is basically the process of evaluating the creditworthiness of a person, institution, or business applying for a loan.

Before you lend money to any borrower, you need to have some degree of assurance that they’ll be able to repay the loan without undue push-and-pull. Consider these five tips for a more efficient credit underwriting process:

1. Track Non-Traditional Data

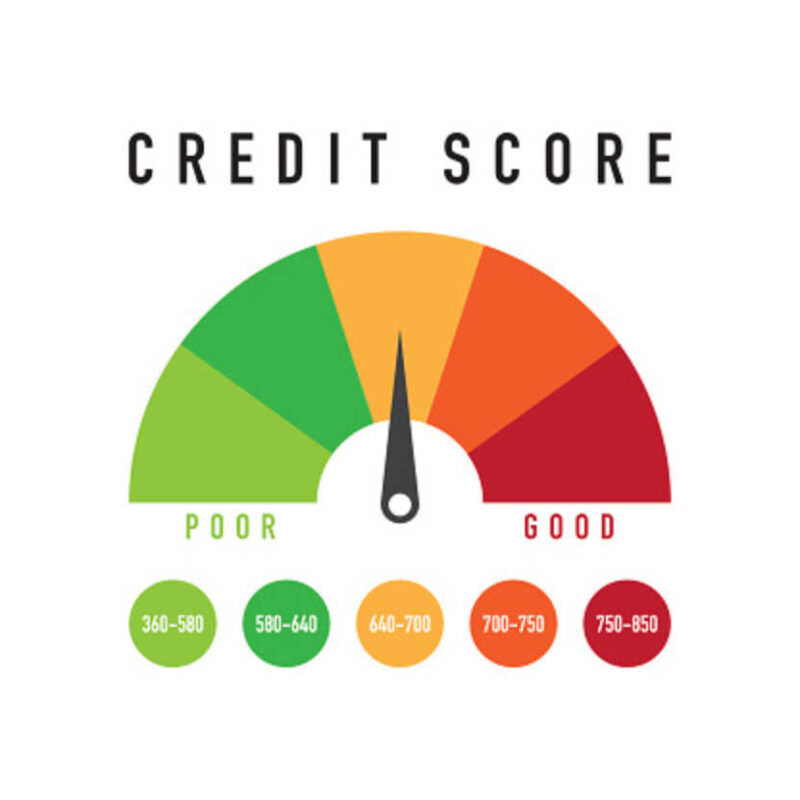

The first port of call when assessing a borrower’s creditworthiness is usually checking their credit score. This is a number between 300 and 850 that indicates the likelihood and ability of a person to repay their loans and debts.

It’s calculated by considering one’s credit history, current total amount of debts, repayment history, and a number of accounts they’re operating. When someone has a credit score above 700, you’re more confident that they’ll repay your cash. On the other side, a credit score below 579 tells you the borrower has had and might have difficulties in clearing debts.

While this system works, it doesn’t favor the following groups of people:

- New immigrants to a country who don’t yet qualify for credit cards

- Those who are too young to legally register for credit cards

- Those who pay only with cash

- People who’ve never used traditional credit accounts

- Those who’ve not used credit for the past 2 years

- Recent applicants for credit cards

Statistics show that, in the US alone, more than 53 million adults fall under these categories. You don’t want to lock out such a huge population from accessing credit. So, instead of using the credit score as the only criteria for assessing creditworthiness, consider tracking non-traditional data, such as payment history, on cellphone bills, utility bills, rent, etc.

To do this, you need to use commercial tools specifically designed to analyze consumer credit data, and give recommendations on whether or not it’s worth it to lend money to a particular borrower. If this is an option you’re interested in, you may check this site for deeper insight into how these tools work.

2. Go Digital

Mark you, this is the 21st century, which spells digital migration. Previous generations relied heavily on paperwork, but with the advanced technology, businesses can now handle a greater percentage of documentation digitally. As a credit underwriting expert, don’t be left behind.

Paper-based loan processes experience setbacks, such as:

- Customer frustration due to unwarranted costs of copying and sending documents

- Incomplete paperwork

- Loss of poorly filed documents

- Delays in form submission

- Chaotic storage spaces as a result of keeping voluminous paper files

But, if you embrace the digital trend, you’ll reap benefits, like:

- Punctual receipt of documents

- Increased capacity in the sense that you can process more applications within a given period of time than it’d have been possible with paper documents

- Reduced costs as you no longer have to pay for shipping of loan application forms

- No loss of important documents since they’re scanned, submitted via the Internet, and stored in the cloud

- Greatly reduced need for voluminous paper storage

3. Restrict Incomplete Submissions

Still on digital submission of loan applications, you don’t want applicants to unnecessarily leave blanks. You’ll usually need details like:

- Full name

- Date of birth

- Social Security number

- Residence history

- Marital status and number of kids

- Employment status and history

- Income statements

- Information on bankruptcy

- Divorce certificates

- Information on any current loan

- Business license

- Signed income tax returns

- Number of employees

- Company history

- Collaterals

Failure of the applicant to provide such critical information will only delay the credit underwriting process. But, thanks to technology, you can design the submission forms in a manner that the applicant can’t submit the application, unless all mandatory fields are filled and every important document is attached. This way, only completely filled applications will reach you, and, thus, save you the burden of handling numerous incomplete forms.

4. Require Cover Letters

As much as the loan application form you provide to potential borrowers is detailed, there remain some bits of information that may not be so obvious by simply filling the form.

Therefore, ask borrowers to write a cover letter, explaining anything unique with their particular loan application. Getting such details up front will help you to better understand the borrower’s intention and quickly seek ways to help them.

And, in another dimension, if you’re passing the shortlisted loan applicants to a higher authority, additionally draft your cover letter providing a precise rundown of the loan amount and purpose, and creditworthiness of the applicant. Don’t merely repeat the obvious details in the application. Focus on those aspects of the application that can’t be understood by looking at the numbers filled.

This helps reduce confusion among the staff responsible for processing loans.

5. Know Your Customer

Popularly known as KYC, this is a critical component of credit risk assessment. You don’t want to lend cash to someone you don’t properly know. As such, make sure the information provided by the applicant is relevant, accurate, and timely. It’s important for you to be able to differentiate fake documents from genuine ones. In times of financial distress, humans can use all tactics possible to get money, and that includes faking documents.

You may also want to use advanced scanners that are able to digitally scrutinize a document against database samples and detect any element of fraud. Such measures will ensure that you’re not loaning dishonest persons.

In addition to that, you can schedule a one-on-one interview with the loan applicant in a bid to elicit all key information from them. Use this opportunity to ask questions that’ll help you gauge the financial traits of your customer. Try to be friendly, but professional. Listen actively and compassionately address all your customer’s concerns.

To Wind It Up

The credit underwriting process can be made more efficient by being smarter in your approach, as outlined in the five tips above. This reduces your risk of bad debts by lending to those customers who are more likely to repay loans. Also, it makes the credit risk assessment process simpler and less time-consuming, which should be the desire of every credit underwriter.

Comeau Computing Tech Magazine 2024

Comeau Computing Tech Magazine 2024